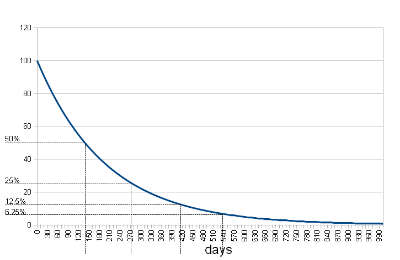

What do complex sales and the radioactive decay rate of atoms have in common? "The rate at which these unstable isotopes [deals] undergo decay varies greatly between the different isotopes [customers]. The process is random for each atom [customer]. However there is a fixed probability that an atom [deal] will disintegrate over a fixed time scale [quarter(s)].The time it takes for the radiation to decay to half of what it was previously is constant and is called the half life [closed lost]."

Believe it or not, I always think of these decay rate charts, a phenomenon occurring in many natural systems, when I'm looking at enterprise selling. What is the said radiation? It's the emotion of senior decision makers and their propensity to overcome the status quo and make a change. It's the heat of the moment and the inspiration to take risk. Draw a graph like this on the white board and map Deal Size and Propensity to Close on the Y axis and time on the X axis. Then draw another horizontal line or watermark halfway up the Y axis to express the status quo. When a customer gets excited about the possibility of change, you've touched a nerve or uncovered pain; emotion flares up and just like a whale tail breaches the water line of the status quo. The fear of not changing outweighs the fear of changing for only a very short amount of time. If you do not get on site, Skype or meaningfully connect in that timeframe (actively listening) to help them make the case with the appropriate deciding stakeholders in the account, the deal will fall back down into the water and decay rapidly to the half life of 'close lost.' Ask yourself this question, how many opportunities have hit the "half life" and are hiding, decaying in your pipeline? It's time to Spring clean out your customer relationship management closet, observe the following universal truths and start to win.

Although enterprise deals ($250K+) on average can often take anywhere from 6 to 16 months to close, if you haven't made a major impact in a quarter or two, you're talking about a massive pull of inertia catapulting deals with whales back down into the dark ocean of "do nothing." Your likelihood of closing the deal is exponentially smaller with every month that goes buy from the original point of high interest. Customers buy on emotion and close on pure logic. Many call this striking while the iron is hot when opportunity knocks, before dying on the vine. Andy Paul has taken this to an even further level of real-time selling or zero-time selling as others like Craig Elias have dubbed the concept as 'first in.' This is a tricky expression and I'll uncover a new way to look at time and engagement in this post as well as a follow-up. There are nuances here that I feel could be more thoroughly explored. I wanted to share some of my unique thoughts about this concept as it relates to the natural world and how I see the ramifications of decay rates and how they're impacting enterprise deals and influencing sales cycle stagnation, or acceleration. It seems like a big mystery until you just look at any system in nature.

Simplicity emerges...

First off, are you currently even hunting whales? With all due respect to these beautiful, mysterious and regal creatures of the undersea kingdom which I do seek to protect, in sales, as a metaphor whale hunting is defined as going full bore after your largest dream clients. Why relegate your team to mediocrity and tire-kickers? I would argue it takes an equal amount of time, money and resources to go after bad deals as it does to target the right ones. Time is money and you're in business to produce dramatic results for clients that are a key fit for your solution. Think as big as you can, then think bigger. Imagine the most incredible deal you could put together with the biggest client with the most complete suite of your solutions. Write this down on paper to memorialize it. What truly constitutes an ideal prospect? Understand every facet of the whale almost like a marine biologist. You are Jacques Cousteau! Which company could your firm foster a strategic partnership with and completely transform their business as well as yours? That's step one: defining the whale and not limiting yourself to that definition. If you can't spot it, how can you hunt it? OK, you may not feel ready but I guarantee you're more ready than you think.

So that leads to the next major question? How do I combat that rate of decay? How can I reconcile enterprise sales cycles with my lack of time, capacity or resources? I need to go raise a round of funding... I need to close in business now. My startup company is at risk... or, as an account executive, I have to make my number, right?

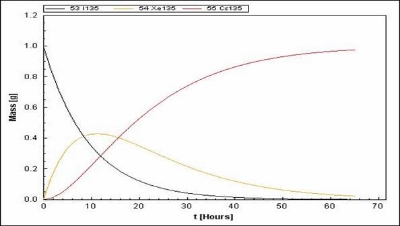

Check out this second graph. Now I can go find thousands of these charts but what we see here is a similarity of diametric motions in competing energy systems. There's the downward pressure of decay and then the acceleration up and to the right of growth and the confluence or crossroads of both. You have a chance to literally insert yourself into deal cycles other competitors have started for you. You can come in out of nowhere (or below from the depths if we stick to this analogy) with more power, force, insight and passion and completely disrupt another decay rate already in play causing your deal to accelerate back up to growth. I would relate this to a block in the game of billiards when you knock the opponents ball off course or position your ball to block the target.

This is why social selling and social networks are so powerful. You can literally generate demand rather than servicing it. The whole traditional idea of web leads, inbound phone calls and the reactive nature of whales coming to you is a recipe for RFP, stalls and low average deal size. Generally, CXO whales deploy and delegate to have several vendors spelunked at once. So waiting for the sector to come to you is a red herring. I've opined ad nauseam about the power of content marketing to create an octopus's garden to attract whales and that's an ongoing Challenge endeavor that Marketing and B2B salespeople should undertake together but that does not forego, the proactive whale hunting mentality each day. The boulder versus the sand is going after at least five whales per day before doing anything else. Don't answer your email, construct an RFP response, work the web leads or build that 55 slide presentation with your NASCAR slide. Don't do anything until you've identified, targeted, followed up with, cold-called or connected with on LinkedIn – at least 5 dream customers before lunch. Every single day. After all, you still have the name "sales" in your title. And if that title disappears industry-wide someone is still going to be responsible for bringing in the revenue of the company. I'd challenge any robot to close a six or seven figure deal. If we get there in my lifetime, I'll eat my shoe. Please hold me to it!

Recently, a CEO argued for the end of selling and how customer service agents could handle it all. He whined about how unfortunate commission plans are. Even if all that were true, somebody in the companies of the future will understand this post and hop on a plane, even go door to door again, and do all this old school analog hunting completely eclipsing the techy folks waiting around for $250,000 self-serve orders to come into the website. I don't know about you but I've never been more suspicious in my life in making a major purchase than right now. In 2015 everything including Ferraris can be purchased on a mobile phone with one click and how on Earth do I know it's not a scam? Is the engine full of sawdust? Am I sending a money order to Dubai? How do I get into the car and test drive it... I'd be shocked to hear of one Fortune 2,000 CEO spending $1MM without face time and even walking the facilities of the vendor. If you're a CXO reading this or you know one that has purchased million dollar enterprise software sight unseen, please comment. I would love a case study, perhaps I'm wrong (but I doubt it.)

You can set off the chain reactions in both charts and be there first, early. I think the thing that Corporate Executive Board research misses and Challenger Sale for that matter, is the goal of insight selling in a real-time ecosystem is to bypass the entire decision making process all together. The entire buyer's decision journey is reactive: they've already started and you're inserting yourself anywhere between 57% to 90%. So it's all focused on engaging early upstream. But who is teaching, don't even compete in an existing buying cycle that has a decay rate. What about the novel idea of triggering the buying cycle yourself? Right, the entire cacophony of "it's not a sales cycle," it's a "buying cycle" is juxtaposed to the sales people I coach actually closing six and seven figure deals with LinkedIn. They're generating demand not servicing it. I would counteract this with the Jobsian thought, "What customer ever knew what they want? We need to show them what they never knew they always wanted." Paraphrasing...

On Monday, hold a meeting with your sales team. Write down the top 10 companies you need to close and what exact deal you want to do: size, solution, stakeholders, etc. Who are you not closing you need to be? I'm sure it's on the tip of your tongue or in the back of your mind. What are the solutions you'll sell and the problems you'll solve? Chances are, you're no longer up periscope searching for whales; you're reactively dealing with a school of fish of smaller accounts - just as high touch, high maintenance - and they're reactively consuming all your time. Have you given up? Recalibrate! Now that you've pinpointed these whales it's time to share your team's knowledge of everything in the accounts: what were the past attempts, do you have paper with any of them, were there past proposals? Have stakeholders you've sold to from other accounts moved into them? Where are the people that signed the POs or SOWs now? All of this is very much a group trigger event tracking exercise and will serve as the wind in your sails to build momentum in this quarter and the next. You are simply getting to know the whales, identifying them before you go after them again.

Reinvigorated by this article? I certainly am. I do this every day and train groups and CXOs to look at their book of business and territory mapping in this novel way. So what now? Go look at the graphs again. Nobody is ever satisfied with what they're using, especially in software. Most people have creeping doubts. Ask someone if they're happy? 99% will mention they could be happier in this area of that. So essentially the flare of change, the breach of the surface of the ocean, the whale tail's rise if you will is happening right as we speak all over the ocean of our sector and customer base. You only need to get out a pair of binoculars, open your eyes from your CRM spreadsheet jockey repose and get out the S.S. Minnow. All you have to do is intercept the decay rate or better yet, CREATE IT! Waves, ebbs and flows - watch them. If you live by a major body of water, go study right now... It holds thousands of years of secrets in its movements. Enterprise sales cycles ebb and flow the exact same way. It's all right there!

When I call on a major customer and I have a cutting edge solution that is superior in many ways I focus on the outcomes and risk. I keep the conversation strategic with the business folks to win the business sale and technical/tactical with the operational technical folks to win the technical sale in tandem. I make a compelling and provocative business case that my competitor is not using. It's unique and data driven. I'm not parroting the magic quadrant report: I tell the story in my own way to deeply engage. It's about them, their quote in the annual report, the media, the blog, the conference. I also realize there's a 3% chance they're actively looking and 40% chance they're open to looking. That 40% is my ocean where I'll create the breach. Jumping dolphins are cool too, fast nimble high growth companies that I can sell into that will create the budget and still have the scaled need. The minute I get customers excited emotionally about improving the state of their business, the risk of change decreases, the system is frictionless and now I have a customer advocate and champion to go cause a Renaissance in the account. Value creation is easy. It's not a one time propositions. It's an upward spiral of how we're working together to either drive revenue or increase operational efficiency on an ongoing basis. Then the decay rate begins...

Let me simplify this for you: If you've got deals over $250,000 in your pipe and you are not actively engaging and moving them through your funnel with enough velocity they will [I repeat]: drown into the status quo of the Doldroms. No doubt about it. The minute something goes white hot in your pipe, you have mere weeks, maybe a quarter to accelerate it so you can be that red sine wave graph up and to the right. You must catch the egg of interest and intent or it will break. These are simple diagrams pulled right out of isotope and atomic decay rate research. But all these decay rates look eerily similar against infinite human systems, as they are fractal. The expenditure of emotion, energy and enthusiasm like echoes into a canyon, is guided by the limitation of Earth time. We all know the greatest enemy of quota is time. That's why we must ferociously protect our calendars against the forces of evil in our own companies masquerading as good. Endless admin, enablement and days of internal meetings does not a top seller make. It's just a law. Companies exist to block their sellers. That may be the greatest paradox of all. Often in an early stage startup I consult, the first step is to pinpoint the sellers who are literally "blocking revenue." Once a shift is made and the able folks are in the right location, a team of 2 can drive more revenue than 10. I've seen it happen too many times it's like some parable in Greek myth. Deal Blockers Anonymous. The anti-sellers reckoning!

Time is of the essence. Identify the whales. Think bigger. Build a sustainable, repeatable [demand gen] mechanism to engage them early before they "die on the vine" and decay and when you see the tail flare up, realize they're most likely engaged with all your competitors. In the enterprise, this is definitely always the case. To prove it, think of your own behaviour? When's the last time you bought a pricey piece of software? Did you not go to Google, submit to multiple web forms and request demos from at least three companies. I recently did this with GoToMeeting, Join.Me and WebEx and had reps from all three selling me, slide-decking me and romancing me for a few months. But if you're first, if you're the one to cause the flare up with a key insight, by helping them see their business or business model in a dramatically new way, you then have this shining moment to accelerate the deal. Is it audacious to think you can revolutionize someone's business who may be very senior to you? Not if you build enough industry expertise by assessing what the leading edge companies are doing you interface with. You generate insight by living it, being out in the field, walking the halls of dream clients and reading like a fiend.

Is it possible to close deals without an inside sales team, field sales team and solely as a CEO founder leveraging marketing automation and LinkedIn alone? Yes. I know of several using stealth social gen technologies now. I know of companies having success with companies like Frontline Selling and Carb.io. There's an inside phalanx of Predictable Revenue sellers too applying the Henry Ford Silicon Valley specialization models. The sales people of the future will understand this and form a strategic alliance with their internal C-Suite. By leveraging stealth B2B social lead gen technology to set unlimited meetings, bonding and having a close knit relationship with the leadership of their own company, and being more proactive than ever, they can pick from a grab bag like bobbing for apples. It will be possible to steal deals right out of the hands of competitors.

We've all had this happen to us. All's fair in love, war and business. And when I say steal, it's like stealing the ball in sports; it's a fair play. If you outsmart your competitors by thinking more strategically, being quicker and more cunning as the fox, it's still counts when you bank it. Technology levels the playing field but technology mixed with strategy is unstoppable. Study military strategy, study the classic strategic selling books you think are collecting dust on the shelf. Don't get too enamored with the Social Selling craze because many of these principles lack the foundation of strategic selling in complex matrixed organizations. You need to garner a very thorough understanding of SPIN selling, TAS, Solution, Strategic, Insight and Power Base before you attempt to do this in social. You will walk right into a hornest nest as you trigger multiple land mines with out a complete and thorough training in the Pantheon.

After all, until they 'sign on the line that is dotted,' it's a free country, free market and the customer or "whale" is in charge. We'd never harpoon the whale, we'd let them harpoon us into a meaningful business relationship of trust that lasts and strengthens itself in an anti-fragile manner where we're providing so much recurring value creation that they'd never sever that tie in the chaos of high growth technology acceleration. We're out ahead innovating in permanent beta. Maybe this post should have been called Whale Rider because I've featured a picture of a photographer capturing the stately mysterious whale shark. You truly want to co-exist with your best customers and forge alliances of trust. It's a simbiotic give and take after all. That's why I love the book Go-Givers Sell More!

If you're limiting yourself on the size of deal you can close, speed you can close it and level of dream customer, you're wasting precious time in your career and taking commission money out of your family's pocket. Go big! Dream bigger and think bigger. There is a ton of great information on trigger events that Tibor Shanto and Craig Elias put out so I must tip my hat to that in this article. I'm going to write a follow up post to this all about "anchoring the sale." This will cover the psychological components and where Cialdini's influence factors in when you do get in "early" and chase the rainbow to find that mythical pot of gold. Don't get bitten by the procurement leprechaun!

Once you spot a prospect that is "whale size" and has embarked on the decay rate journey there are ways to anchor the deal before it falls off that are critical to bringing the revenue home and booking it. The role of social media, LinkedIn, Twitter and persistent cold-calling techniques coupled with them as well as how to leverage on-site and interactivity become key here. Look for Part II.

Happy hunting and closing! Once you catch the whale, psyche! realize they caught you and coexist with them. Admire their beauty. Go for a swim in the ocean of healthy profit margins, recurring revenue and a virtuous cycles of mutual growth!

Now it's your turn: What makes deals die? Why do some accelerate and others stall? How are you leveraging strategic selling systems, processes and technology to compete in big deals or accelerate your sales cycle? Curious...

If you valued this article, please hit the ‘like' and ‘share’ buttons below. This article was originally published in LinkedIn here where you can comment. Also follow the award winning LinkedIn blog here or visit Tony’s leadership blog at his keynote speaker website: www.TonyHughes.com.au.

Main Image Photo by Flickr: Marcel Ekkel